tax on venmo cash app

The new cash app regulation isnt a new tax. Why things changed The changes to tax laws affecting cash apps were passed.

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

I do part time babysitting and I get paid through Venmo or Cashapp for that.

. Squares Cash App includes a partially updated page for users with Cash App for Business accounts. 1 day agoPerhaps thats why one Twitter user seemed surprised by the platforms relative scale. On it the company notes this new 600 reporting requirement does not.

Currently cash apps are required to send you 1099 forms for transactions on cash apps that exceed a total gross payment of 20000 or exceed 200 transactions total within a. Millions of people have trusted our service to file their taxes for free and. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle.

Cash App for example tweeted on Feb. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. Life doesnt always give you lemons sometimes it gives you a Lego to step on or a chocolate chip cookie thats brimming with raisins.

I dont know anyone who uses Zellebut its handling 2x Venmo and Cash App combined read. 4 that it will send 1099s just to users enrolled in its Cash App for Business program. 4 that it will send 1099s just to users enrolled in its Cash App for Business program.

The P2P peer-to-peer payment apps have soared in popularity in recent years. Instead the reporting requirements for digital payment apps such as Venmo and PayPal have changed. Day-to-day activity like sending your friend.

Rather small business owners independent. The only difference you. A new tax law went into effect that requires third-party payment processors to report business transactions that meet certain new thresholds to the IRS.

More than 60 million people use the Venmo app for fast safe social payments. An FAQ from the IRS is available here. Robot artist Ai-Da reset while speaking to UK politicians.

New Cash App Tax Reporting for Payments 600 or more. Anyone who receives at least. January 19 2022.

17 hours agoVenmo offers a variety of features beyond basic cash transfers including its own-branded credit and debit cards. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Cash App for example tweeted on Feb.

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more. Under the prior law the. PayPal and Venmo TaxesTax Rules for Cash Apps and 1099-K Form Explained.

And for many people in 2023 life. Day-to-day activity like sending your friend. Here are some details on what Venmo Cash App and other payment app users need to know.

In the past few years I didnt make enough to file taxes - less than 12550 per year - so I just didnt do it but I am. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. The app also incorporates social elements ones that have.

Cash App Taxes formerly Credit Karma Tax is a fast easy 100 free way to file your federal and state taxes. Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS. Venmo is a digital wallet that makes money easier for everyone from students to small businesses.

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule.

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

What Is Cash App Pros Cons Features Nextadvisor With Time

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Merchants Using Payment Apps Will See 2022 Tax Changes I3 Merchant Solutions

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

New Irs Rule Requires Paypal Cashapp To Report Payments Over 600

The New 600 Cash App Tax Law Explained Answering Your Questions Starting January 2021 Users Of Their Prefered Third Payment Network Will Begin Receiving Tax Forms 1099 K If They Receive

Fact Or Fiction Could We Soon Owe Taxes On Venmo Payments

New Law Impacting Peer To Peer Payment App Users

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Does The Irs Want To Tax Your Venmo Not Exactly

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

New Rule To Require Irs Tax On Cash App Business Transactions Katv

Stop Sending Money On Venmo There Are Better Alternatives Wired

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

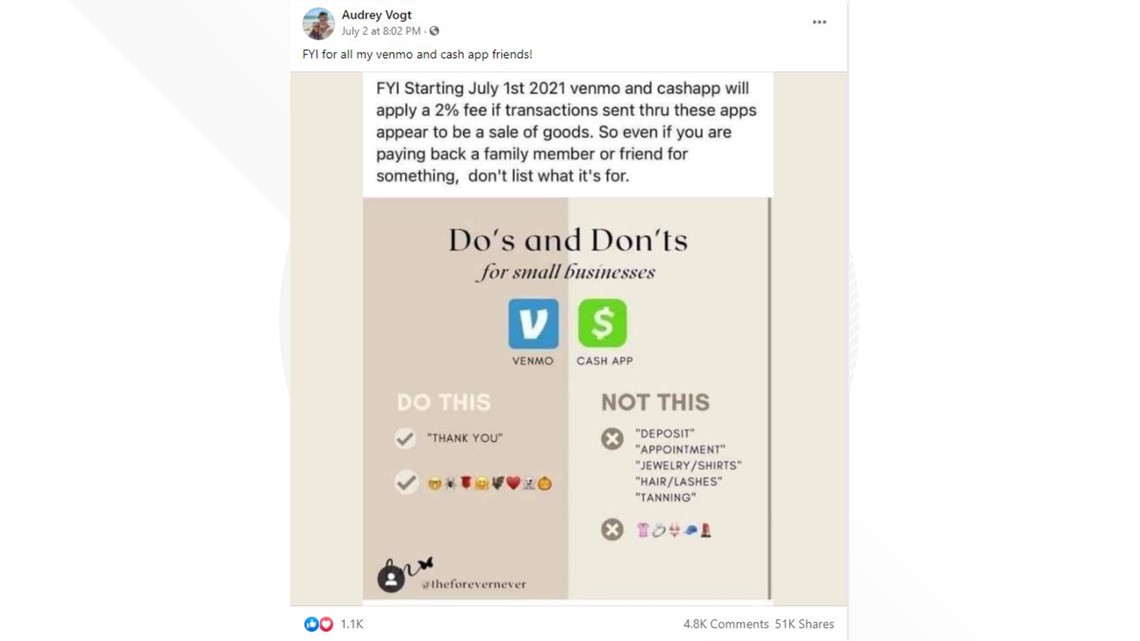

Venmo Will Have New Service Fees But You Have To Opt In Verifythis Com

Beware Of New Tax Rule Affecting People Who Use Venmo Paypal Or Other Payment Apps Tax Attorney Orange County Ca Kahn Tax Law